Official Government-Backed Partnership

Transforming Taxation. Empowering the Nation.

A private consortium advancing tax systems, regulatory excellence, and digital growth for national prosperity.

The New Philippines

“With Bagong Pilipinas (the new Philippines) as our guiding light, we embark on a journey toward modernization, progress, and inclusivity.

Together, we will see the implementation of crucial mandates underpinned by law and the full support of the Philippine government.

Let us celebrate this milestone as a moment of unity, purpose, and shared commitment to building a brighter future while paving the way for a modernized nation!”

About the Consortium

Our Mission:

To build a stronger Philippines by advancing digital transformation, enhancing regulatory excellence, and fostering innovation through strategic collaboration. The Consortium is committed to driving sustainable economic growth, efficient governance, and inclusive progress, empowering every Filipino and creating a modern, future-ready nation.

ADVANCING THE NATION THROUGH INNOVATION

Who We Are and Why We Exist

The Philippines Modernization Consortium, a for-profit stock corporation, was established to advance LCCAD’s mandate by accelerating digital platforms in internet transactions and digital interactive media. Focused on driving the growth of the Philippine Creative Industries and e-commerce sector, the Consortium champions innovation, regulatory excellence, and sustainable digital transformation.

With priority focus on the VAT on Digital Services Law (Republic Act No. 12023) and the Ease of Paying Taxes Act (Republic Act No. 11976), we are committed to enhancing tax collection efficiency, ensuring regulatory compliance, and accelerating digital transformation aligned with national economic goals.

12%

Standardized VAT rate on digital services

4

National agencies aligned

2024

Year rollout was initiated across platforms

$1.9B+

Projected revenue over five years

Unity, Renewal, and Progress

Why Bagong Pilipinas?

The Philippine Modernization Consortium (PMC) is part of a broader national movement toward renewal and innovation. The Bagong Pilipinas campaign symbolizes this transformation: a Philippines that is unified, resilient, and future-ready.

Each element of the Bagong Pilipinas logo mirrors PMC’s mission: the Rising Sun for new beginnings, the Three Stars for nationwide unity, the Red and Blue Bands for dynamic growth, and the Circular Shape for collaboration.

PMC helps bring the spirit of Bagong Pilipinas to life, not in words, but in action.

Consortium Members

LCCAD Holdings Corporation

Legal mandate and regulatory enforcement

Holdun Family Office

Capital, PMF oversight, and technology infrastructure

T2 Pinans Holdings

Domestic operations, financial oversight, and compliance

MODERNIZATION IN MOTION

A New Era of Collaboration: Inside the Launch of the PMC

On February 27, 2025, business leaders and government representatives gathered in Pasay City to officially launch the Philippine Modernization Consortium (PMC).

Opening Remarks & Launch Overview

Manuel “Nong” C. Rangasa

President & CEO, LCCAD Holdings

Answering the Call of the President

Brendan Holt Dunn

CEO, Holdun Group of Companies

Putting Pen to Policy: The Official Launch

Elected representatives sign the Memorandum of Agreement.

Marking the Moment: PMC Agreement Signed

Agreements signed, marking a strategic alliance to drive investment and growth.

Partners Align to Modernize the Philippines

PMC partners include LCCAD, T2 Pinans, Holdun Group, Cypher by Holt

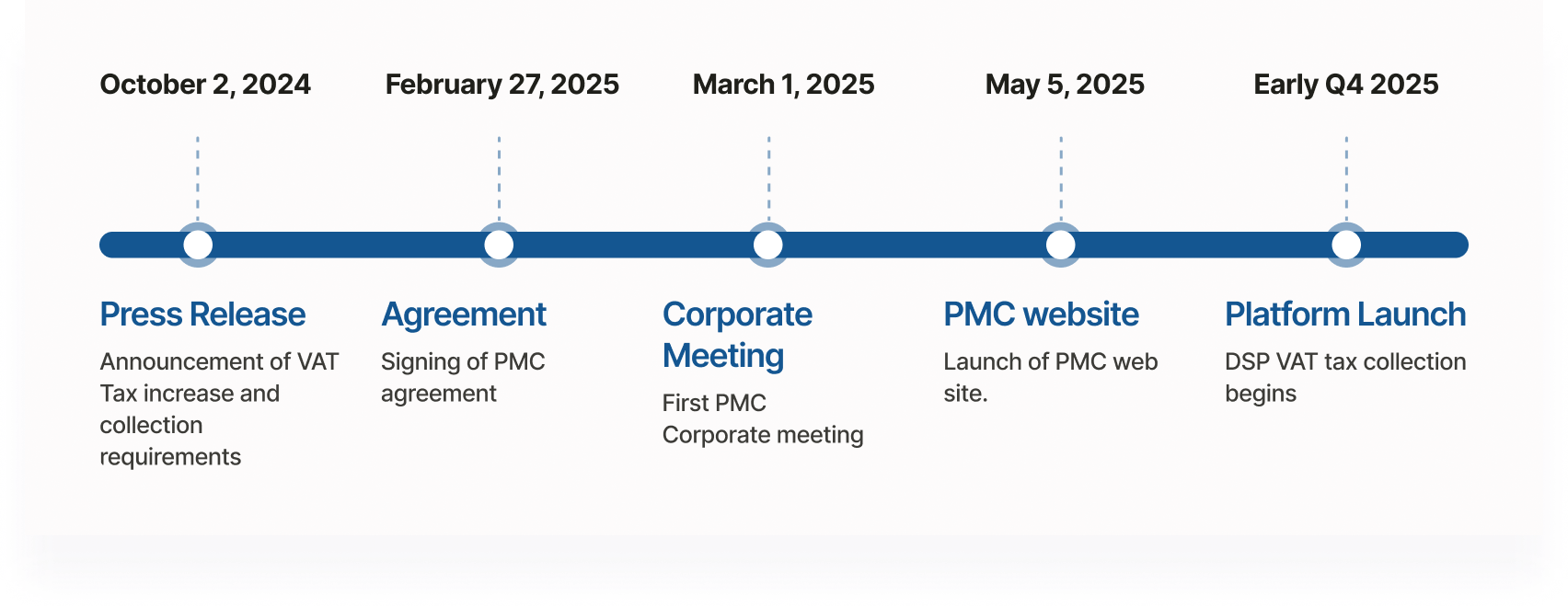

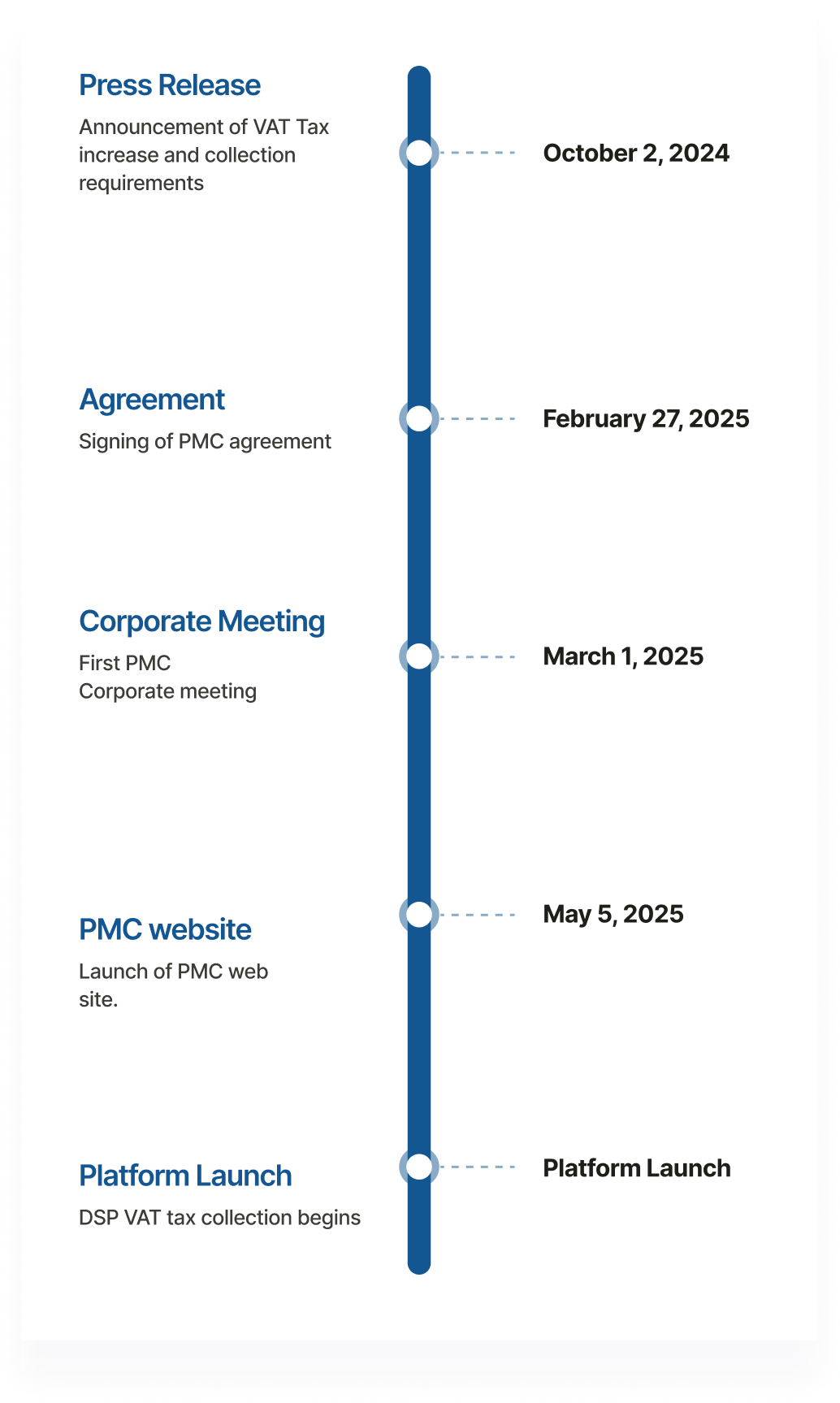

PMC Timeline of Key Milestones

A chronological look at the key events driving national modernization

The Philippines Modernization Fund

The Philippine Modernization Fund (PMF), led by Holdun, is a sovereign-aligned investment platform designed to direct global capital toward transformative national projects across the Philippines. Rooted in the legacy of Sir Herbert Holt, one of Canada’s foremost economic visionaries and Brendan Holt Dunn’s great-great-grandfather, the PMF draws on a heritage of nation-building through bold financial leadership.

Today, that legacy continues to evolve in the Philippines through strategic investments that accelerate digital infrastructure, advance financial innovation, and foster inclusive economic growth.

PMC is the exclusive modernization consortium for the Philippines under a 25-year renewable legal mandate authorized by LCCAD Holdings Corporation.

Our Jurisdiction

The LCCAD 9 Domains

The 9 Domains listed serve as the core of the modernization agenda, derived from RA 11904 and enhanced by the PMC’s mandate

- Creative Industries

- E-commerce & MSMEs

- Bio-circular Green/Blue Economy

- Smart Infrastructure

- Public-Private Partnerships

- Regulatory Compliance

- Digital Transformation

- Financial Inclusion

- Transparency & Innovation Platforms

Vat Mandate

It’s More Than Policy. It’s the Law.

In 2024, the Philippines passed the VAT on Digital Services Law (RA No. 12023). The mandate is clear.

To enforce it, the Bureau of Internal Revenue (BIR) introduced the VDS Portal, ensuring that global platforms delivering digital services in the Philippines, despite having no local presence, are now required to register, file, and remit VAT. It’s a direct response to the growing complexity of taxing cross-border providers like streaming services, e-commerce platforms, and cloud-based software companies.

What Counts as a Digital Service and Who Provides It?

Under Senate Bill 2528, a digital service is any service delivered through the internet or an electronic network using information technology, where the process is largely automated. This broad definition covers a wide range of offerings, from cloud storage and online marketplaces to digital goods, streaming platforms, search engines, and other online media or platforms.

A Digital Service Provider (DSP) refers to any entity, whether based in the Philippines or abroad, that supplies these digital services to Philippine consumers. When a DSP operates without a physical presence in the country, it is classified as a non-resident. These non-resident providers are now directly subject to VAT obligations under Philippine law.

Source: Asean Briefing from Dezan Shira & Associates

Corporate Mandate

The Consortium through LCCAD’s corporate mandate, successfully advocated for critical legislation including:

- Philippine Creative Industries Development Act (RA No. 11094)

- Internet Transactions Act (RA No. 11967)

- Ease of Paying Taxes Act (RA No. 11976)

- VAT on Digital Services Law (RA No. 12023)

- CREATE More Act (RA No. 12066)

Operations & Oversight

By integrating LCCAD Holdings Corporation into its framework, the Consortium ensures:

- Strategic alignment

- Operational efficiency

- Financial sustainability for long-term goals

A Fully Integrated System for Sustainable Growth

Our strategic initiatives channel resources, including VAT collections and service fees, into transformative projects that drive:

- Sustainable Economic Growth

- Infrastructure Development

- Ease of Paying Taxes Act (RA No. 11976)

- Technological Advancements

- Social Progress

How we do it

Our Framework

Streamlined digital tax frameworks powering a unified national strategy.

VAT on Digital Services Law (RA No. 12023)

Ratified by the Senate on July 29, 2024, and the House on July 30, 2024, the VAT on Digital Services Law (RA No. 12023) empowers the Bureau of Internal Revenue (BIR) to effectively collect VAT from Digital Service Providers (DSPs).

Key Objectives:

- Establish clear compliance measures for DSPs.

- Foster a competitive, zero-risk environment for local and global providers.

- Ensure fair tax practices across industries such as streaming services, digital interactive media, and e-commerce platforms.

This modernization ensures fair competition, strengthens government revenue, and supports national development through streamlined digital tax frameworks.

Regulating Markets

The Consortium will implement a Cockpit Offline Transactions strategy in the Philippines to address the need to increase tax revenue by regulating identified “gray markets”, activities such as online casinos and online Sabong.

This initiative involves the immediate installation of government-issued POST (Platform for Online System Taxation) machines in all cockpits nationwide. This mandate is in compliance with Republic Act No. 11904 of 2022, also known as the Philippine Creative Industries Development Act (PCIDA) and the Internet Transactions Act (ITA) of Republic Act No. 11967 of 2023.

Media Coverage Highlights

A snapshot of national media and social coverage about PMC

Digital Economy Shift

A New Chapter in Digital Taxation

What Every Filipino and DSP Must Know

As of 2025, foreign and local digital service providers are subject to VAT in the Philippines. This short video explains what changed, who’s affected, and what this means for your business, your wallet, and the nation’s future, and how this new law strengthens the country’s digital economy.

The PMC Executive C-Suite Leadership & Board of Directors

The C-Suite of the Philippine Modernization Consortium (PMC) ensures efficient national execution, global financial governance, technology development, and compliance. Each executive represents a core pillar of the Consortium’s operations.

The Board of Directors governs PMC with strategic oversight, fiduciary responsibility, and compliance authority. Each party to the Consortium holds official representation on the Board.

Manuel “Nong” C. Rangasa

Chairman of the Board

Provides governance leadership, legal continuity, and public-private alignment through LCCAD’s national mandate.

Brendan Holt Dunn

Co-Chief Executive Officer (Co-CEO)

Oversees global affairs, foreign investment, and the Philippine Modernization Fund (PMF). Represents Holdun Family Office.

Vice-Chairman of the Board

Leads the PMC’s international development strategy and oversees financial and investment governance.

Jose Equiña Reyes Jr.

Co-Chief Executive Officer (Co-CEO)

Leads domestic operations, national modernization implementation, and regulatory execution. Represents T2 Pinans Holdings.

Executive Board Member

Responsible for strategic alignment and operational delivery across all modernization initiatives.

Robert Wagner

Chief Technology Officer (CTO)

Leads the development of secure, scalable, and government-compliant digital infrastructure. Oversees the integration of Holt 360 systems.

Executive Board Member

Ensures technological innovation and cybersecurity compliance across PMC systems.

Mark Gerald Javier

Chief Operating Officer (COO)

Directs day-to-day operations, compliance, and regulatory liaison with government agencies. Represents LCCAD Holdings Corporation.

Gordon Dempsey

Chief Financial Officer (CFO)

Manages capital allocation, budgeting, and financial oversight of the PMC’s operations and CAPEX/OPEX structure.

Cedric M. Sazon

Board Member

Serves as an institutional representative and policy advisor in coordination with financial institutions and stakeholder bodies.

Strategic Collaboration

A Unified Commitment

University of the Philippines

Academic engine behind digital governance and research.

United Nations Association of the Philippines (UNAP)

Global perspective and sustainable development alignment.

Department of Trade and Industry (DTI)

Drives platform readiness and regulatory modernization.

Bureau of Internal Revenue (BIR)

Ensures effective tax enforcement and nationwide integration.

House Committee on Ways and Means

Legislative catalyst for implementing fiscal transformation.

Coalition Partners

Frequently

Asked Questions

What is the Philippine Modernization Consortium (PMC)?

Who are the official members of the PMC Consortium?

The Consortium is composed of three principal parties:

- LCCAD Holdings Corporation – Grants the legal mandate and provides regulatory and enforcement support.

- Holdun Family Office (Bahamas) Limited – Leads capital formation, fund management, and global financial infrastructure.

- T2 Pinans Holdings – Manages daily operations, compliance, and execution of national modernization initiatives.

What is the legal basis for PMC’s authority?

What are the LCCAD 9 Domains?

The 9 Domains refer to the strategic sectors defined under Republic Act No. 11904 and enhanced by the PMC’s scope, which include:

- Creative Industries

- E-commerce and MSME development

- Bio-circular green and blue economy

- Climate-smart infrastructure

- Public-private partnerships

- Digital taxation and regulatory compliance

- Sustainable development initiatives

- Financial inclusion

- Digital platforms for innovation and transparency

What laws support PMC’s operations?

- RA 11976 – Ease of Paying Taxes Act

- RA 11967 – Internet Transactions Act

- RA 11904 – Philippine Creative Industries Development Act

- RA 11765 – Financial Products and Services Consumer Protection Act

- RA 10771 – Philippine Green Jobs Act

- RA 10644 – Go Negosyo Act

- RA 8792 – Electronic Commerce Act

- RA 8759 – Public Employment Service Office Act

What Agencies does PMC Interfaces With?

- SEC – Securities and Exchange Commission

- BIR – Bureau of Internal Revenue

- BSP – Bangko Sentral ng Pilipinas

- DTI – Department of Trade and Industry

- BOI – Board of Investments

- BI – Bureau of Immigration

- PAGCOR – Philippine Amusement and Gaming Corporation

- LGUs – Local Government Units for Mayor’s/Business Permits

What are the PMC registration & compliance documents?

- SEC Registration

- BIR Certificate of Registration

- Municipal/Mayor’s Permit

What is the VAT on Digital Services, and how does PMC help implement it?

What is PMC’s role with Digital Service Providers (DSPs)?

How does PMC contribute to Overseas Filipino Workers (OFWs)?

PMC aims to modernize remittance channels and financial services for OFWs and their families by:

- Reducing transaction costs

- Improving access to secure digital banking tools

- Supporting cross-border payment innovations

This aligns with PMC’s broader mission of financial inclusion.

How is PMC governed?

A multi-stakeholder Board of Directors oversees PMC with representation from each party. Its day-to-day operations are led by:

- Brendan Holt Dunn, Co-CEO

- Jose Equiña Reyes Jr., Co-CEO

- Mark Gerald Javier, Chief Operating Officer (COO)

- Robert Wagner, Chief Technology Officer (CTO)

- Gordon Dempsey, Chief Financial Officer (CFO)

Where can I get updates or contact PMC?

Visit https://philmodernization.com.ph for official updates, or email the Consortium directly via the contact form. Regular news bulletins, public advisories, and digital compliance guides for DSPs will be posted as implementation advances.

Ensuring Compliance. Empowering Collaboration.

Whether you’re a stakeholder, media partner, or government official – we’re happy to connect!

Big Things Start With One Message.

Got a question or idea? Send it in and we’ll route it to the right decision maker fast